Why Now Is the Time to Invest in Transportation Electrification

Or: How to Future-Proof Your Business While Everyone Else Waits Around

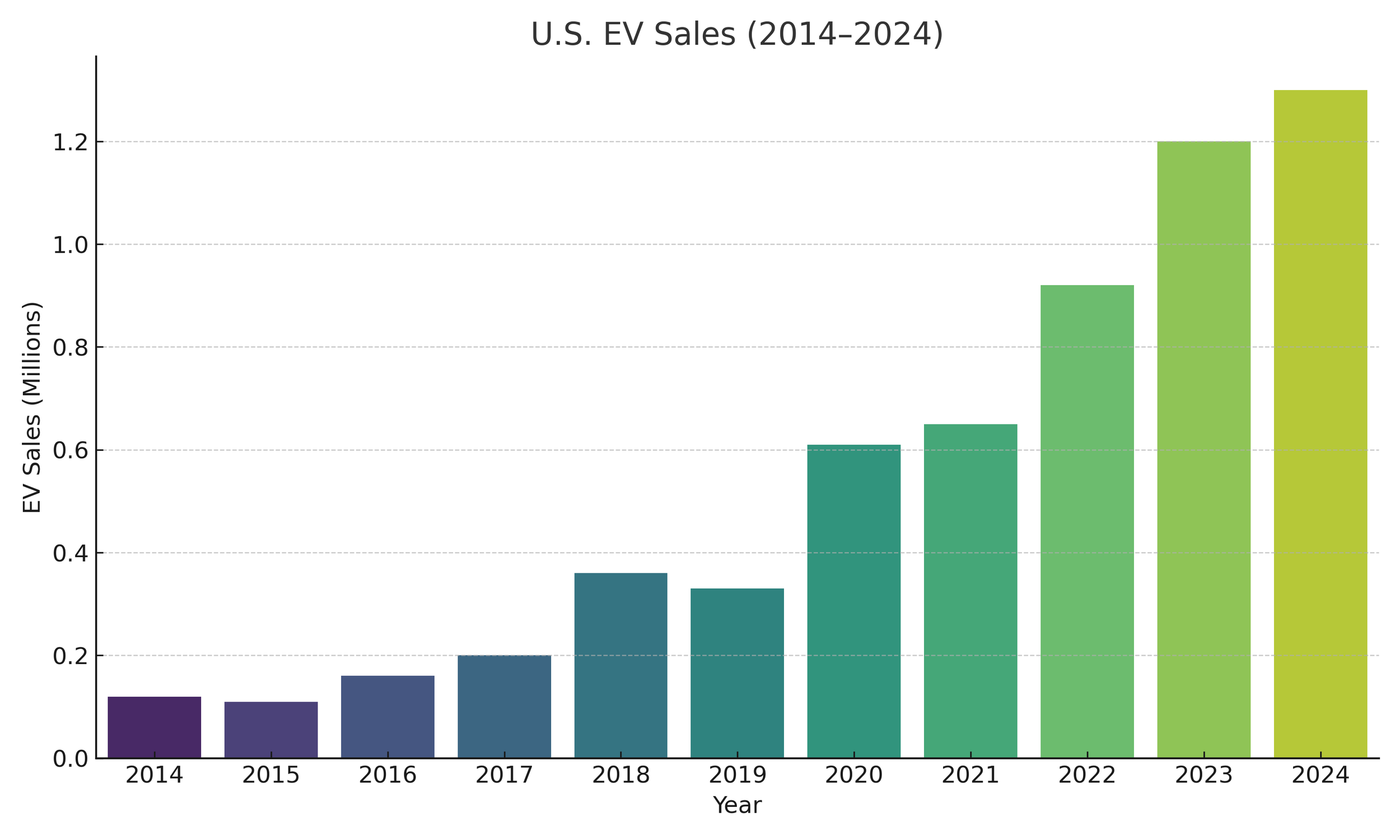

U.S. EV sales grew from 120,000 in 2014 to approximately 1.3 million in 2024, representing more than 8% of all new vehicle sales.

Source: Cox Automotive, AutoForecast Solutions.

Electric vehicles have gone from early adoption to everyday reality. For over a decade, the EV market has seen consistent growth, and today, automakers are all-in, rolling out new models to meet surging demand. This shift is creating ripple effects across industries, especially in infrastructure, energy, and real estate. The road ahead isn’t just electric, it’s wide open for those ready to take the wheel.

Translation: if you’ve been waiting for a sign to invest in EV charging or electrification, this is it. And no, it’s not just about being "green." It’s about being smart.

What’s Driving the Opportunity?

And Where the Smart Money’s Going?

Let’s get the federal part out of the way. Yes, there’s been some belt-tightening and shifting priorities at the national level, but instead of slowing down the market, it has simply shifted focus. The real momentum is now with utilities, local governments, and private businesses stepping up to lead.

States like California, New York, and Michigan are all in on EV deployment, offering incentives, rolling out infrastructure plans, and setting aggressive targets. Utilities are modernizing their grids, and businesses are realizing that charging infrastructure is no longer a nice-to-have. It’s a competitive differentiator.

The real story here isn’t just growth, it’s value creation. Across fleet electrification, grid modernization, and property development, investment opportunities are stacking up. Whether you're looking for recurring revenue, asset appreciation, or strategic partnerships, the electrification movement is opening doors in ways the market hasn’t seen since the early days of the internet or solar.

Who Stands to Gain (Spoiler: Pretty Much Everyone)

Local Governments

Programs like the Low Carbon Fuel Standard (LCFS) can help cities and counties build EV infrastructure, reduce emissions, and unlock new revenue. If you're in city leadership looking for a win on sustainability, economic development, and community visibility, this is your moment.

Utilities

More EVs mean more electricity sold, and that’s a win on its own. But the real opportunity lies in doing it strategically. Utilities that embrace controlled, beneficial load growth can often accommodate increased demand using existing generation and distribution assets. When the load is predictable and well-managed, it reduces the need for expensive system upgrades and helps maximize profitability. On the flip side, uncontrolled load growth can trigger major capital investments, stretch infrastructure, and reduce long-term returns. The difference is not just technical. It is financial.

Those who invest early in EV charging load management strategies and customer programs will not only stay ahead of the curve, they will help shape where it goes.

For investors, this means new revenue streams tied to predictable, manageable energy usage. Utilities that incentivize EV charging during off-peak hours can unlock tremendous value avoiding costly infrastructure upgrades while boosting load factor. Partnering early with utilities to develop these strategies (or offer solutions that support them) is one of the most overlooked opportunities in the market today.

Property Managers and Developers

Tenants and buyers are looking for charging now, not in five years. Adding EV infrastructure is more than a nice amenity. It attracts premium tenants, opens the door to rebates, and increases long-term property value. Wait too long, and you’ll be the building next door with nothing but a dusty bike rack.

Charging as an Amenity = Value Multiplier

EV charging isn’t just a checkbox, it’s a competitive edge. Properties with charging stations are commanding higher lease rates, attracting eco-conscious tenants, and qualifying for local incentives. In some markets, offering charging can boost occupancy and resale value more than other traditional amenities like gyms or pools. Investors in real estate or REITs should be looking at EV infrastructure not as a cost, but as an appreciating asset.

Fleet Electrification: A Growth Engine in Motion

Fleets, public and private, are electrifying at an accelerating pace. Companies that supply, install, or support fleet charging have a multi-year runway of demand ahead. From delivery vans and municipal vehicles to ride-share and school buses, there’s a growing need for charging depots, managed software, and maintenance contracts. This is infrastructure with built-in customers and repeat business potential.

Private Businesses

Retailers, fleets, restaurants, and hotels are already investing. Why? Because charging customers are spending customers. Whether they’re grabbing coffee, groceries, or an overnight stay, offering EV charging turns your parking lot into a business driver.

This Isn’t the First Infrastructure Gold Rush

A quick look in the rearview mirror shows us the pattern.

The Interstate Boom

When the highways were built, smart businesses moved quickly to stake their claim. Gas stations, motels, and fast-food chains that saw the writing on the pavement are still around today. This is that moment, version 2.0.

The Solar Surge

Federal solar incentives dipped in the early 2010s, but state programs and the private sector kept things moving. The result? Rapid adoption, falling costs, and today’s solar leaders. Those who leaned in early didn’t just survive. They set the pace.

Space and Transit Innovation

When public dollars pulled back, private players like SpaceX and even local transit authorities stepped in and filled the gap. Reduced federal support did not stop innovation. It often sparked it.

Yes, It’s Complex. But It’s Manageable.

Permitting takes time. Utility coordination can be tricky. Upfront costs are real. But these are all solvable problems, especially when you plan and work with people who’ve done it before.

Every major infrastructure shift comes with a learning curve. That is normal. And it is also where the biggest long-term gains tend to happen.

Why Now?

EV adoption is accelerating. Technology is improving. Customer expectations are evolving. You can either play catch-up later or get ahead now.

Whether you’re a city planner, a utility, a commercial property owner, or a business operator, this is a rare opportunity to lead. Electrification is not just coming. It is already here, and getting in early gives you a real advantage.

At StrategEV, we help organizations plan, fund, and execute smart electrification strategies built for long-term success.

Let’s talk. Because timing is everything.