Why Now Is the Time to Invest in Transportation Electrification

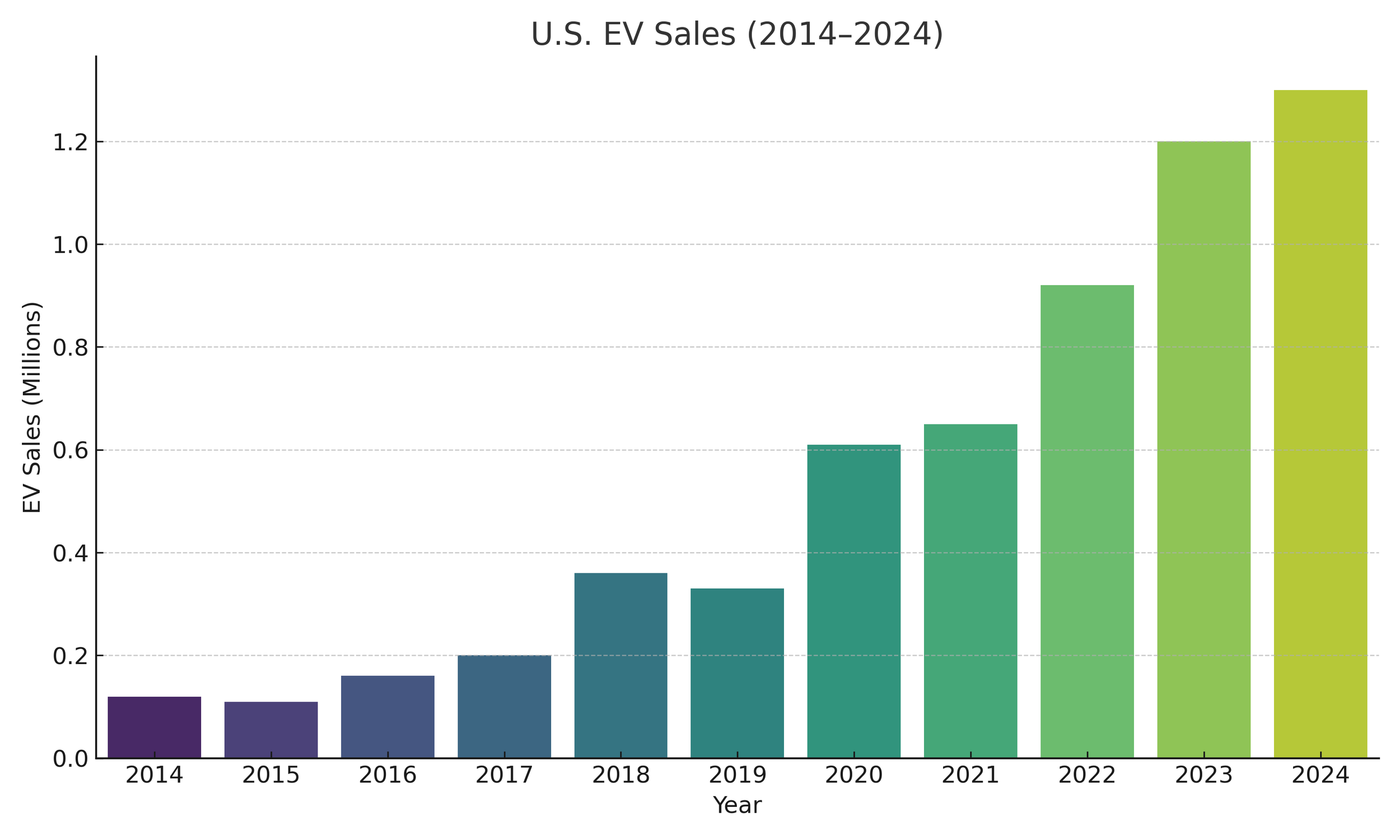

Electric vehicles have gone from early adoption to everyday reality. For over a decade, the EV market has seen consistent growth, and today, automakers are all-in, rolling out new models to meet surging demand. This shift is creating ripple effects across industries, especially in infrastructure, energy, and real estate. The road ahead isn’t just electric, it’s wide open for those ready to take the wheel.

Translation: if you’ve been waiting for a sign to invest in EV charging or electrification, this is it. And no, it’s not just about being "green." It’s about being smart.

What’s Driving the Opportunity?

And Where the Smart Money’s Going?

Let’s get the federal part out of the way. Yes, there’s been some belt-tightening and shifting priorities at the national level, but instead of slowing down the market, it has simply shifted focus. The real momentum is now with utilities, local governments, and private businesses stepping up to lead.

States like California, New York, and Michigan are all in on EV deployment, offering incentives, rolling out infrastructure plans, and setting aggressive targets. Utilities are modernizing their grids, and businesses are realizing that charging infrastructure is no longer a nice-to-have. It’s a competitive differentiator.

The real story here isn’t just growth, it’s value creation. Across fleet electrification, grid modernization, and property development, investment opportunities are stacking up. Whether you're looking for recurring revenue, asset appreciation, or strategic partnerships, the electrification movement is opening doors in ways the market hasn’t seen since the early days of the internet or solar.

Who Stands to Gain (Spoiler: Pretty Much Everyone)

Local Governments

Programs like the Low Carbon Fuel Standard (LCFS) can help cities and counties build EV infrastructure, reduce emissions, and unlock new revenue. If you're in city leadership looking for a win on sustainability, economic development, and community visibility, this is your moment.

Utilities

More EVs mean more electricity sold, which is a win on its own, but the real opportunity lies in managing this growth wisely. When charging demand is predictable and well-managed, utilities can often serve it using existing infrastructure. That means more revenue without major capital upgrades.

The flip side is uncontrolled growth, which can trigger costly system investments and strain long-term returns. The utilities that invest early in load management strategies, renewable energy generation, and customer programs won’t just stay ahead of the curve, they’ll shape it.

For investors and partners, that creates opportunities tied to reliable, profitable energy usage and programs that incentivize charging during off-peak hours.

Property Managers and Developers

Tenants and buyers are looking for EV charging today, not years from now. Adding infrastructure is more than a nice amenity , it’s a competitive advantage. In many markets, properties with EV charging are commanding higher lease rates, attracting eco-conscious tenants, and qualifying for incentive programs. Charging is no longer just a perk, it’s a competitive advantage that strengthens both occupancy and long-term property value.

Fleet Electrification: A Growth Engine in Motion

Fleets, public and private, are electrifying at an accelerating pace. Companies that supply, install, or support fleet charging have a multi-year runway of demand ahead. From delivery vans and municipal vehicles to ride-share and school buses, there’s a growing need for charging depots, managed software, and maintenance contracts. This is infrastructure with built-in customers and repeat business potential.

Private Businesses

Retailers, restaurants, and hotels are already investing. Why? Because charging customers are spending customers. Whether they’re grabbing coffee, groceries, or an overnight stay, offering EV charging attracts new customers and keeps them around longer. Studies show EV drivers spend more time and money at the businesses where they charge, turning parking lots into profit centers.

This Isn’t the First Infrastructure Gold Rush

When the interstate highway system was built, smart businesses moved quickly to stake their claim. Gas stations, motels, and fast-food chains that saw the writing on the pavement captured prime locations and built brands that still thrive today.

EV charging and electrification present a similar moment. The companies that invest early and strategically will secure the best sites, customers, and partnerships. Those who wait risk being left at the off-ramp while competitors speed ahead.

This article is the first in a new series on transportation electrification. In the weeks ahead, I’ll be sharing more insights on strategies, funding opportunities, and roadblocks that businesses can turn into advantages.

The Time to Act Is Now

Yes, electrification comes with challenges, but these are solvable, and can be profitable, with the right planning and experienced partners. Every major infrastructure shift has a learning curve, and history shows that those who act early tend to reap the biggest long-term rewards.

EV adoption is accelerating, technology is improving, and customer expectations are rising. You can either play catch-up later or get ahead now.

At StrategEV, we help organizations plan, fund, and execute smart electrification strategies built for long-term success. Let’s talk — because timing is everything.